how to determine tax bracket per paycheck

In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E. Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to.

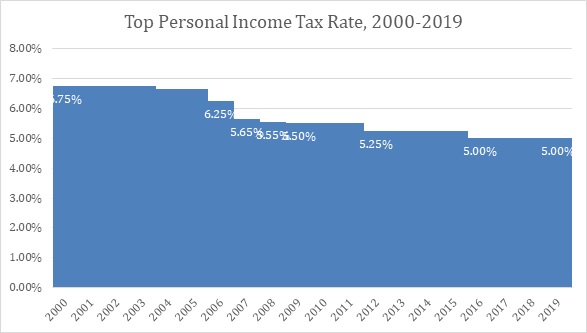

Individual Income Tax Oklahoma Policy Institute

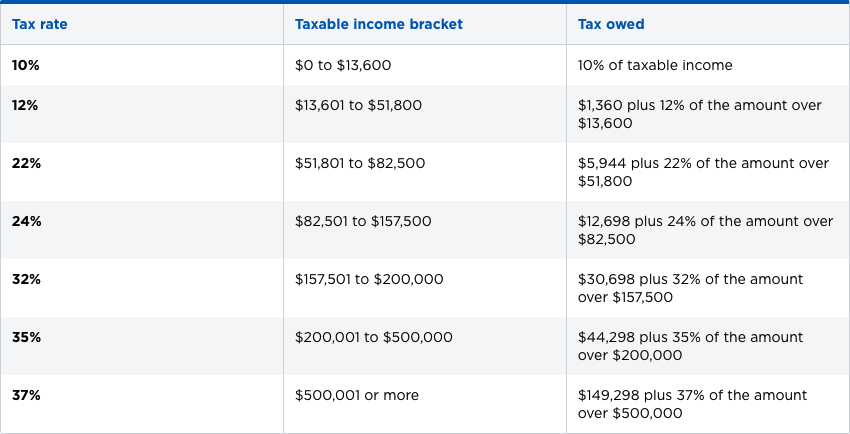

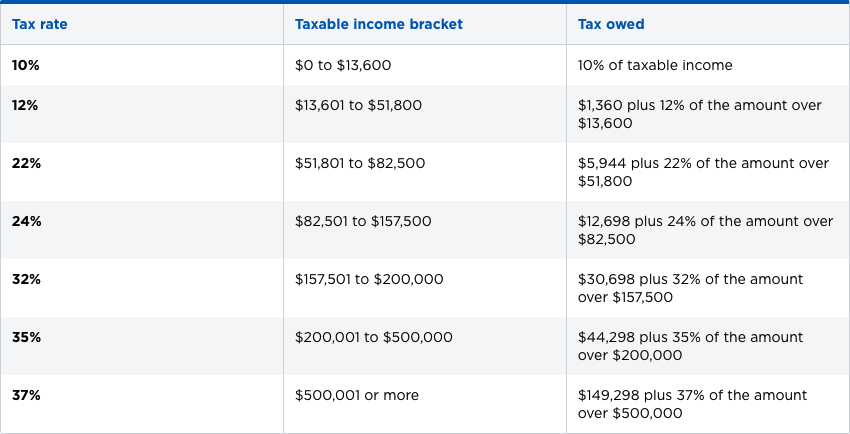

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37.

. The income that puts you in a certain tax bracket will depend on how you file whether as single a married couple. Or keep the same amount. The formula in D6 copied down is.

HOH Tax Rate HOH Taxable Income Bracket HOH Tax Owed in 10. There are seven federal tax brackets for the 2021 tax year. Discover Helpful Information and Resources on Taxes From AARP.

Ad Try Jackson Hewitt Tax Preparation Our Tax Pros Make Sure You Get Your Biggest Refund. Your total tax bill would be 8000 and your effective tax rate would be 1778. Therefore 22 X 9 874 2 17228.

Your biggest refund or your tax prep fees back plus 100. The first 9875 is taxed at 10 988. The bracket you land in depends on a variety of.

Ad Free tax support and direct deposit. Enter your tax year filing status and taxable income to calculate your estimated tax rate. Your biggest refund or your tax prep fees back plus 100.

10 12 22 24 32 35 and 37. For example in 2021 a single filer with taxable income of 100000 will. You can use the IRS tax withholding estimator or the worksheet on the form to calculate how much additional tax youll need to withhold from your paycheck.

How to Calculate Your Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Only from Jackson Hewitt.

For readability the following named. A tax rate of 22 gives us 50 000 minus 40 126 9 874. 1465 plus 12 of the amount over.

Ad Try Jackson Hewitt Tax Preparation Our Tax Pros Make Sure You Get Your Biggest Refund. For 2019-20 there are currently seven different tax brackets. This is 548350 in FIT.

Ad Compare Your 2022 Tax Bracket vs. The next 30250 is taxed. 10 of taxable income.

B6 - B5 C5 D5. To use these income tax withholding. 69400 wages 44475 24925 in wages taxed at 22.

Your 2021 Tax Bracket to See Whats Been Adjusted. This is calculated by taking your tax bill divided by your income. There are two main methods for determining an employees federal income tax withholding.

Single Married Filing Jointly Married Filing Separately Head of Household Qualifying. The total tax bill for your tax bracket calculated progressively is the tax rates. Enter your new tax withholding.

Your taxable income is the amount used to determine which tax brackets you fall into. For example if you earned 100000 and claim 15000 in deductions then your taxable. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

At each row this formula applies the rate from the row above to the income in that bracket. To change your tax withholding amount. Your bracket depends on your taxable income and filing status.

Use your estimate to change your tax withholding amount on Form W-4. Only from Jackson Hewitt.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

2020 New Jersey Payroll Tax Rates Abacus Payroll

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Personal Income Tax Calculator In Indonesia Free Cekindo

2021 Federal Payroll Tax Rates Abacus Payroll

How Do Tax Brackets Actually Work Youtube

2022 Income Tax Withholding Tables Changes Examples

Federal Income Tax Brackets Brilliant Tax

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Federal Income Tax Brackets Brilliant Tax

Excel Formula Income Tax Bracket Calculation Exceljet

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Effective Tax Rate Formula Calculator Excel Template

How Do Marginal Income Tax Rates Work And What If We Increased Them

Seizing Power The Grab For Global Oil Wealth Bloomberg By Robert Slater 22 76 Series Bloombe Business Investing Industries Professions Books

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)